Getting The COVID-19 EIDL Updates - Maximum Loan Amounts - OH IN KY To Work

The smart Trick of EIDL Questions Answered: SBA Expert Update Webinar - NFIB That Nobody is Talking About

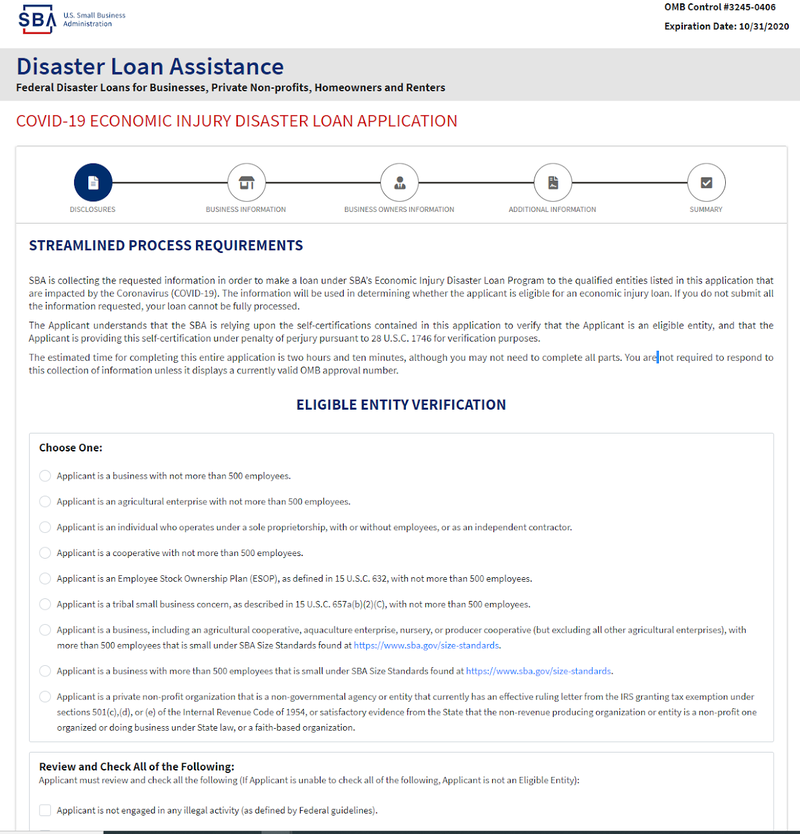

Company Details This section is the longest and requires your income statement since Jan. 31, 2020. It is essential to note that not all responses are needed. Areas marked with a red star must be submitted. If not so marked, only fill them out if they use to your business.

Answers Shown Here apply for an EIDL loan or a PPP loan? Here's the difference"/>What Government Loan Program Should You Apply For?

![PPP Loans vsEIDL: which one is right for your small business [Infographic] - IHCC Business](https://sbgfunding.com/wp-content/uploads/2021/04/EIDL-Update-1.png)

Read and review an EIDL loan document before accepting it - FAQs — COVID Loan Tracker

If owned by people, you need to offer details on each owner who has a 20% stake in business or more. Details requested will include: Home address, Phone number, Social Security number, Date and birthplace, Citizenship status Extra Details This section includes concerns about criminal charges against any owners, then continues to submission of the application.

Got an EIDL Loan - Not Sure How You Can Spend It?

The Main Principles Of SBA ups EIDL loan maximum to $2M - Accounting Today

The application can be discovered on the SBA Disaster Loan Support webpage. The SBA has extended the application due date to Dec. 31, 2021. Do not confuse the brand-new Targeted EIDL Advance with the previous EIDL Advance, which is no longer offered. You can not look for the Targeted EIDL Advance. If you certify, the SBA will call you.

The Targeted EIDL Advance was signed into law Dec. 27, 2020, as part of the Consolidated Appropriations Act (CAA), 2021 and supplies targeted "businesses found in low-income communities with additional funds to ensure little service continuity, adaptation, and resiliency." This program offers up to $10,000 in forgivable funding to previous EIDL applicants who: Are situated in a low-income community as specified by area 45D(e) of the Internal Earnings Code; and, Can demonstrate a more than 30% decrease in income during an eight-week duration beginning on March 2, 2020, or later on; and, Previously received an EIDL Advance for less than $10,000 If you fulfill all of the credentials above and: Gotten no advance due to lack of offered funding; and, Have 300 or less staff members You might also be qualified for the Targeted EIDL Advance.